income tax registration malaysia

On the First 20000. The two category forms.

Income Tax Number Registration Steps L Co

Where a company commenced operations.

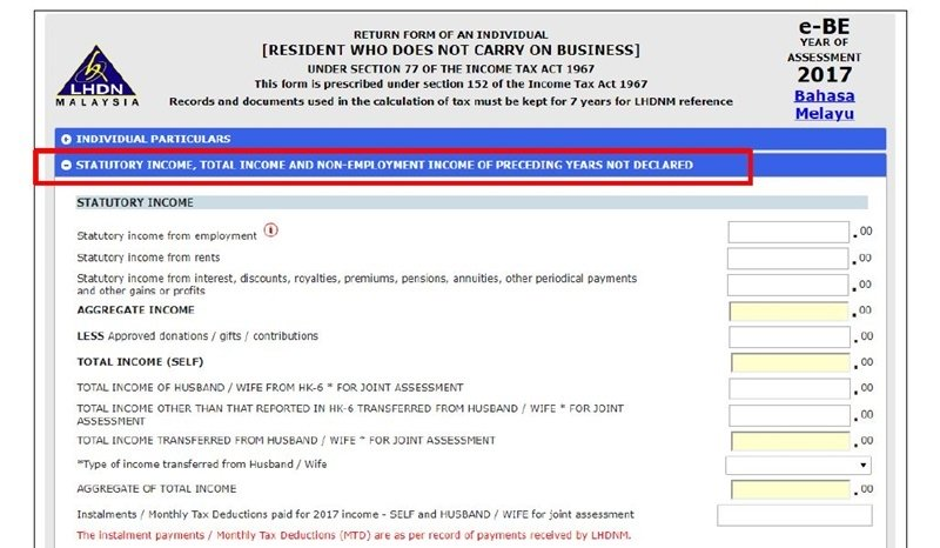

. Income tax filing is carried out under two form categories in Malaysia. Calculations RM Rate TaxRM A. Your income tax number and PIN to register for e-Filing the online.

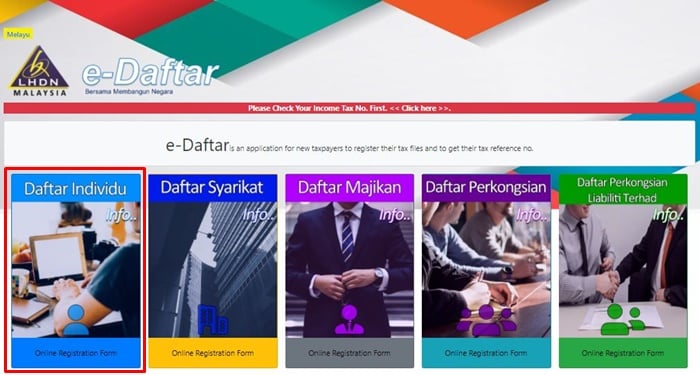

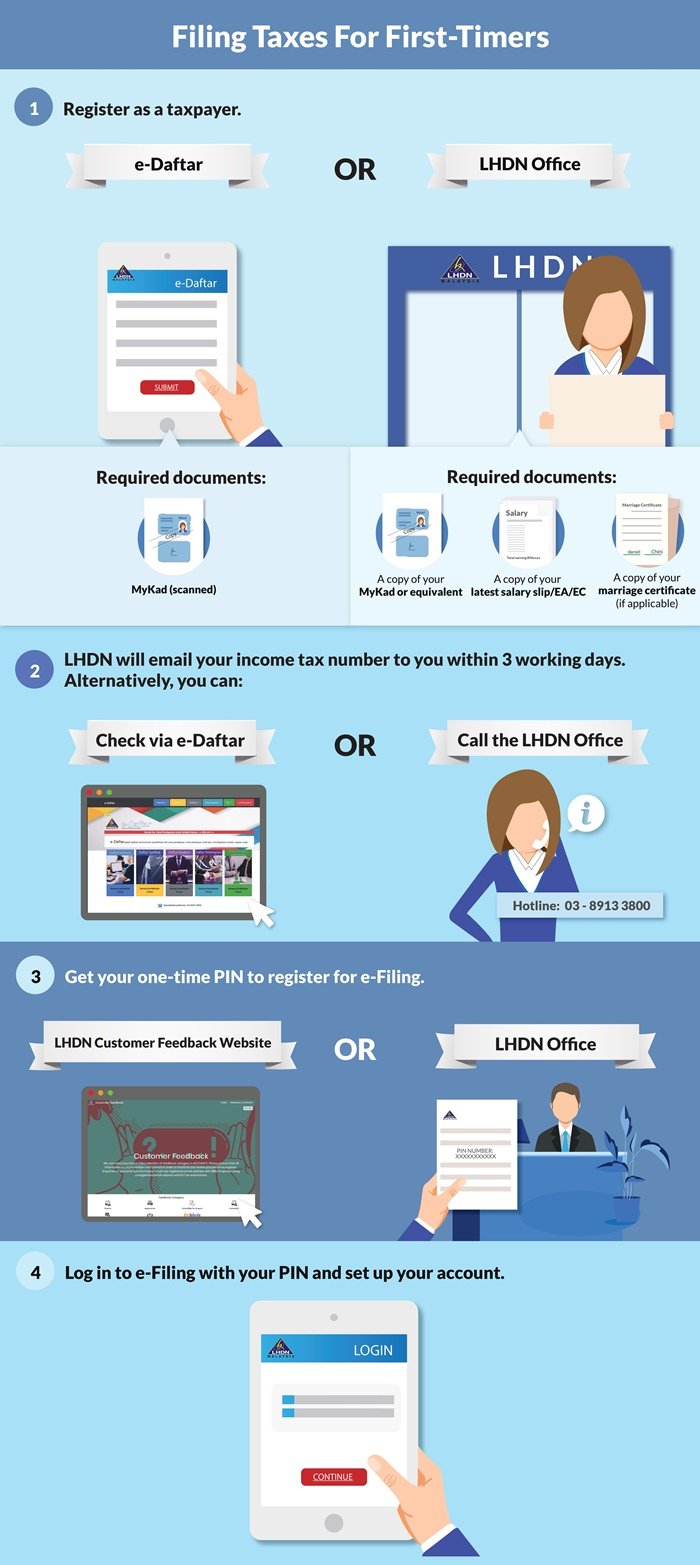

Resident individual who carry on business with employment and other income. Copy of Form D The Certificate of Registration from CCM 4. You can get your income tax number by registering as a taxpayer on e-Daftar and you can get your PIN after that either online or by visiting a LHDN branch.

If this is your first time filing your taxes online there are two things that you must have before you can start. Each has individual time limit that has been allocated for respected tax payers. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis.

In this online method an employer need to directly log. Expatriates that are seen as residents for tax purposes will pay. Download Form - Registration.

Income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia. On the First 5000 Next 15000. Any business with a yearly turnover in excess of MYR.

Registration Steps 1. Registration of companys tax file is the responsibility of the individual who managing and operating the company. Please select Category and Year then click Search button to see the display.

Expatriates that have been working in Malaysia for longer than 182 days in a year are considered tax resident. If your annual employment income is above that figure you will need to do two things. Copy of Identification Card Passport of Candidate Partners 2.

Register yourself as a taxpayer to LHDN and then register for e-Filing which is LHDNs. Visit LHDN Website LHDN website httpsedaftarhasilgovmyindividudafsgjpnvdprdphp 2. Melayu Malay 简体中文 Chinese Simplified Inland Revenue Board of Malaysia IRBM Income Tax Department.

This Income Tax Office info page is to provide information such as address telephone no fax no office hours and etc. Check out our step. All tax residents subject to taxation need to file a tax return before April 30th the following year.

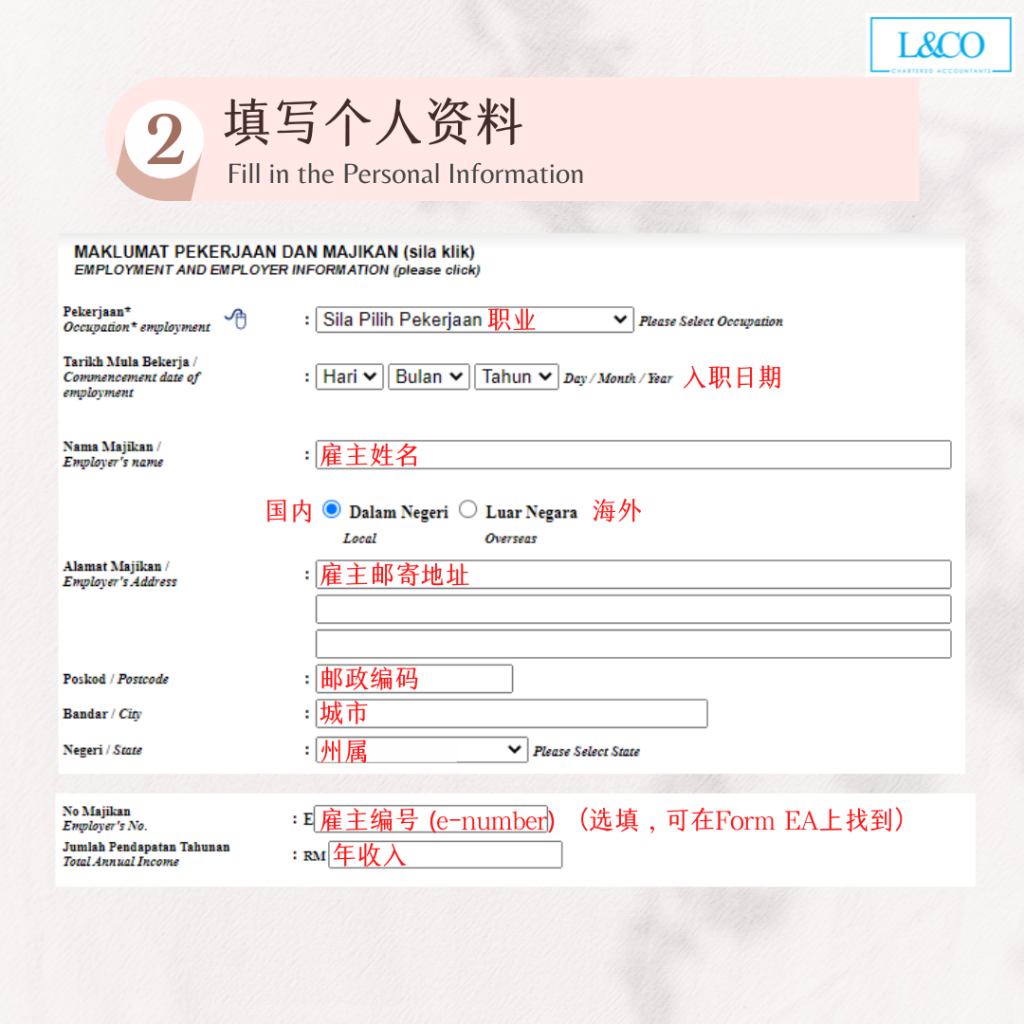

The tax year in Malaysia runs from January 1st to December 31st. They need to apply for. Fill in the Personal Information Fill in.

Forward the following documents together with the application form to register an income tax reference number E-Number- 1. This post is also available in. Other income received by individuals companies cooperatives associations.

Income tax is tax imposed on income from employment business dividends rents royalties pensions and. Resident individual with employment income and does not carry on business. TAX IDENTIFICATION NUMBER TIN 1 Income Tax Number ITN The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the oard.

Through this online process both registering submitting monthly tax deductions in Malaysia is convenient and time saving. It has about 100 branches including UTC nationwide. A Copy 1 Memorandum and Articles of Association 2.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. The tax filing deadline for person not carrying on a business is by 30.

Failure to do so. On the First 5000. On the 1 st of March 1996 the Inland.

Copy of up to date audited account 3.

Never Filed Income Tax Before Here S A Simple Guide On How To Do It Online World

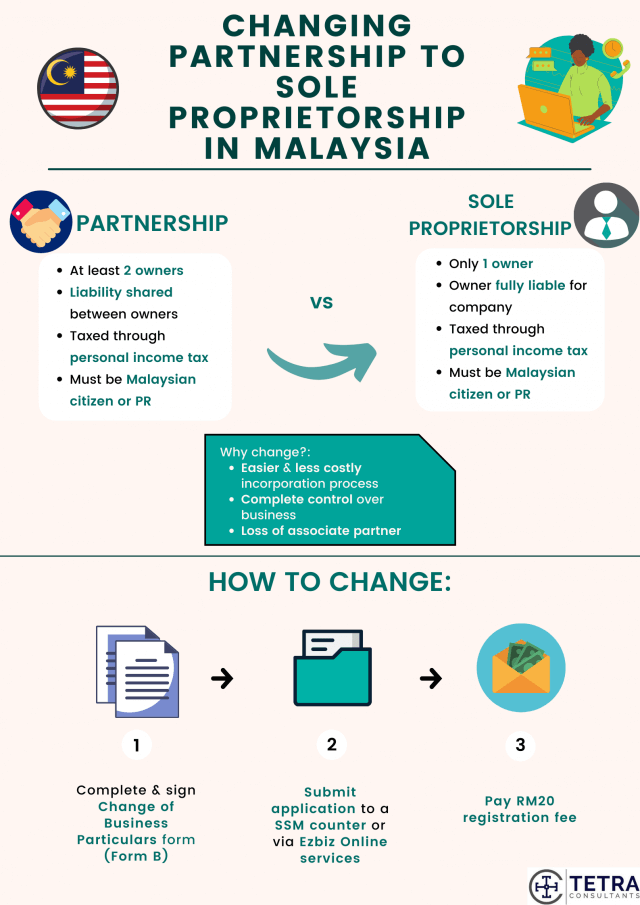

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

Vehicle Registration Licensing Fee Calculators California Dmv

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

First Time Taxpayer Registration Guide Income Tax Malaysia 2022 Youtube

Form Cp 58 Duty To Furnish Particulars Of Payment Made To An Agent Dealer Or Distributor Etc Malaysian Taxation 101

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Corporate Tax Registration Requirement Services By Ct Corporation Wolters Kluwer

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

How To File Income Tax For The First Time

Income Tax Filing Malaysia E Filing And Corporate Tax Return

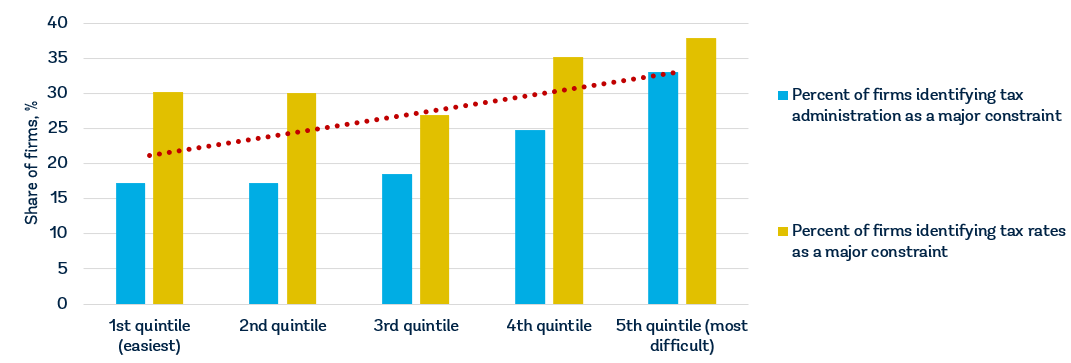

Why It Matters In Paying Taxes Doing Business World Bank Group

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

0 Response to "income tax registration malaysia"

Post a Comment